Are you in need of quick cash but have bad credit? Sure Credit Loan could be an option worth exploring. As one of the leading digital lenders in Nigeria, Sure Credit Loan aims to make borrowing easy and convenient for Nigerians.

This article provides a comprehensive overview of Sure Credit Loan, including how it works, customer reviews, contact details, and step-by-step instructions on downloading the mobile app.

Let’s start our journey with an illustrative story. John just got fired from his job unexpectedly. With his rent due in a week and no savings to fall back on, he’s feeling desperate.

That’s when a friend told him about Sure Credit Loan. Within hours, John was able to get a small loan online to tide him over until he finds new work. To learn how John and many others have gotten quick cash when they needed it most, keep reading!

How Sure Credit Loan Works

Sure Credit Loan offers online personal loans ranging from ₦5,000 to ₦300,000 over flexible repayment periods of 3-12 months. The application process is completely digital and can be completed on their website or mobile app. Here are the basic steps:

Step 1: Apply Online

Submit a simple application providing personal and employment details. This takes just 5 minutes.

Step 2: Pre-Approval Decision

For most applicants, a decision on pre-approval is given instantly. However, some may need to provide extra documentation for verification.

Step 3: Accept Loan Terms

If pre-approved, review and accept the loan agreement which details the amount, repayment schedule, fees and interest rates.

Step 4: Receive Funds

Approved loans are dispersed very quickly, often within 24 hours, straight into the applicant’s bank account.

Step 5: Repay as Scheduled

Borrowers pay back the loan amount plus interest and fees in equal installments over the chosen term, via automated bank deductions.

The entire process from application to fund disbursement takes only a day or two for most. Late or bounced payments impact credit scores, so it’s important to repay as agreed.

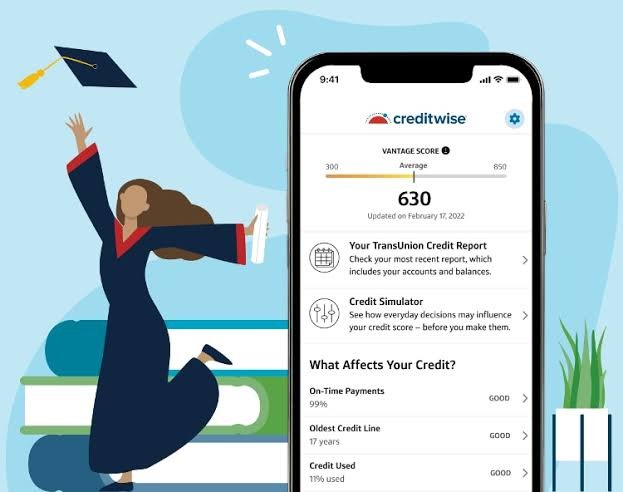

Eligibility Criteria

To qualify for a Sure Credit Loan, applicants must meet the following basic eligibility criteria:

- Nigerian citizens aged 18-65 years

- Valid means of identification

- Active bank account in good standing

- Stable source of income through formal employment or business

- Monthly income of at least ₦30,000 after deductions

- No history of defaults or lawsuits on previous loans

While a good credit history isn’t mandatory, it can influence the loan amount and terms approved. Applicants with incomplete or unverifiable documents may have their applications rejected.

Interest Rates and Fees

Sure Credit Loan is upfront about all applicable charges, which can range from 20-33% depending on the loan amount and term. Some key figures:

- Interest Rates: Typically 26-30% per annum

- Penalty Interest: Usually 2% above standard rate for late/missed payments

- Processing Fee: 5-10% of loan amount deducted upfront

- Bank Transfer Fees: ₦100-₦300 for funds disbursement and repayment

- No prepayment penalties if loan is paid off early

Do the math carefully to understand your total repayment obligation before accepting loan terms. Late payments can add substantially to overall costs.

Contact and Support Details

For any inquiries, complaints or loan process issues, here are Sure Credit Loan’s main contact details:

Website: www.surecreditloan.com

Email: support@surecreditloan.com

WhatsApp: 08130000000

Facebook: @surecreditloan

Toll-Free Number: 0800-SURECREDIT (0800-787-327)

Respond promptly to verification requests to avoid delays. Have questions answered by an agent within standard business hours (M-F 9am-6pm WAT). Escalate severe issues to the provided email ID.

Downloading the Sure Credit Loan App

Accessing loans via their mobile app allows current and potential customers to check rates, apply, and manage accounts on the go. Here is a step-by-step guide:

Step 1: Google Play Store or Apple App Store – Search for “Sure Credit Loan” and locate the app.

Step 2: Install App – Tap “Install” and wait for download completion.

Step 3: Open App – Find and launch the Sure Credit Loan app from your home screen.

Step 4: Sign Up/Login – New users register with basic details, existing customers login with credentials.

Step 5: Begin Using Features – View loans, start/check application status, view statements and make repayments.

Step 6: Keep App Updated – Automatic updates or manual updates ensure you have the latest features and bug fixes.

The app provides a convenient way to access credit from anywhere, anytime. Ensure strong passwords and login security to safeguard financial information.

FAQs

How to borrow credit from Yes?

To borrow credit from Yes Finance, you can apply online by providing initial information for a quick assessment. If eligible, a more detailed application will be required. Interest rates range from 14.9% to 24.9% for secured loans and 24.9% for unsecured loans.

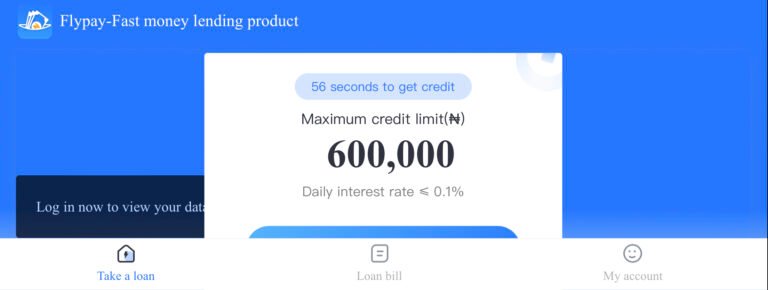

How much can I borrow from Newcredit loan?

According to the search results, the maximum loan amount you can borrow from the Newcredit loan app is ₦500,000. The Newcredit app offers loan amounts ranging from ₦10,000 to ₦300,000.

The maximum loan amount on the Newcredit loan app is ₦500,000

Conclusion

In conclusion, Sure Credit Loan has become a popular choice for working Nigerians needing quick access to credit. While review evidence indicates some customer dissatisfaction around costs, most praise the convenient service when help is urgently required.

Prospective borrowers must closely assess their individual circumstances and repayment capacity before taking a loan. Responsible personal finance habits like budgeting, emergency savings and debt consolidation can also help reduce long-term dependence on high-cost lending sources.

Overall, Sure Credit Loan represents a practical option worth considering for credit needs, when approached judiciously and transparently.