How to get DotPay POS, Login, Charges, Daily Target, Become Dotpay Agent, DotPay POS Customer Care Phone and Whatsapp Number

In this article, we will take you through the process of acquiring a DotPay POS device, how to use it, the associated charges, and even the steps to become a DotPay agent. Whether you’re a business owner looking to make a living with side hustle, just make sure you read this article to the very end.

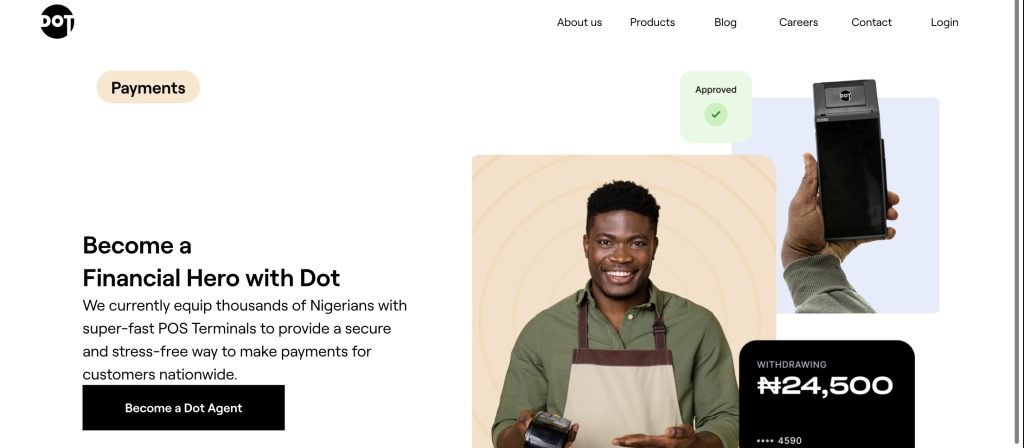

What is DotPay POS?

DotPay POS is a portable payment solution that allows you to accept payments from customers using various payment methods, including debit and credit cards, bank transfers, and mobile money. It ensures the security of transactions through advanced encryption technology, making it a trusted choice for both businesses and customers.

What are the requirements of Dotpay POS?

If you aspire to become a DotPay agent and enjoy the benefits of this payment ecosystem, you must meet the following prerequisites:

- Be a registered business in Nigeria

- Possess a valid means of identification

- Have an active bank account

- Own a smartphone or tablet

- Maintain a stable internet connection

How to Get DotPay POS

Acquiring a DotPay POS device is very simple than what you could ever thought. Without much talks, you can follow these steps to get started.

1. Register with DotPay

Visit the DotPay website and complete the registration process. Ensure you provide accurate information during registration.

2. Order a DotPay POS Device

Contact DotPay customer care to place an order for your DotPay POS device. They will guide you through the ordering process.

3. Fund Your DotPay Account

Deposit funds into your DotPay account using bank transfers or mobile money. This step ensures you have the necessary balance to process payments.

How to Login to DotPay POS

Logging into your DotPay POS account is essential for managing your transactions and settings. Here’s how to do it:

Visit the DotPay Website

Access the DotPay website using your preferred web browser.

Click on “Login”

On the website’s homepage, locate and click on the “Login” button.

Enter Your Credentials

Provide your username and password in the designated fields.

Click “Login”

Click the “Login” button to access your DotPay POS account.

Once logged in, you’ll gain access to your transaction history, daily target tracking, and account settings.

DotPay POS Charges

DotPay POS charges are very affordable. The transaction charges are 2.5% for debit cards and 3.5% for credit cards. There are also monthly charges of NGN 1,000. There is no daily target for DotPay POS agents.

How to Become a DotPay Agent

Becoming a DotPay agent offers lucrative opportunities. Follow these steps to become part of the DotPay network

1. Meet the Requirements

Ensure you meet all the prerequisites for becoming a DotPay agent.

2. Contact DotPay Customer Care

Reach out to DotPay customer care and initiate the application process.

3. Provide Documentation

Submit the required documentation as specified by DotPay.

4. Pay the Application Fee

Complete the application process by paying the necessary fee.

Upon approval of your application, you will gain access to order a DotPay POS device and start accepting payments from your customers.

## DotPay POS Customer Care Phone and WhatsApp Number

For any inquiries or assistance regarding DotPay POS, you can contact DotPay customer care through the following channels:

- Phone: 234 700 036 8466

- WhatsApp: +234 817 036 9507

Feel free to reach out with your questions, concerns, or support needs.

Conclusion

Thanks for reading to the end of this article. I assure you that by following the steps outlined in this guide, you can acquire a DotPay POS device, navigate its features, manage associated charges, and even explore the opportunity to become a DotPay agent.

FAQs

How much is DOT POS in Nigeria?

the price is around N25,000, including the caution fee. Some aggregators may also charge a registration fee, which can range from N5,000 to N10,000.

How much does Moniepoint POS cost?

The Moniepoint POS costs N21,500. This includes the caution fee, logistics fee, and insurance fee for one year.

Which bank owns PalmPay?

PalmPay is owned by Transsnet Financial, a joint venture between Chinese mobile phone maker Transsion and NetEase, a Chinese internet company.