Welcome to crypto Finance Job. Our topic to day is on how to delete, close or deactivate Okash loan account as fast as possible.

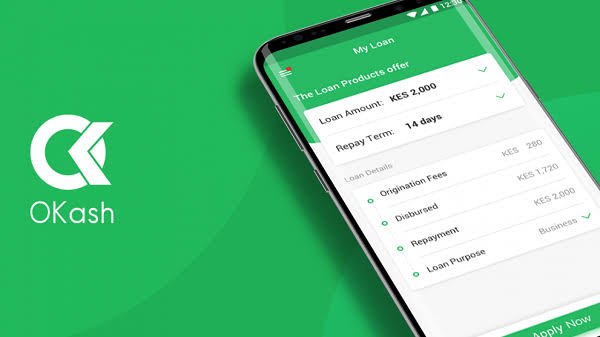

OKash is a popular mobile lending platform in Nigeria that provides instant loans to qualified borrowers. While these loans can be helpful in times of financial need, it’s crucial to manage them responsibly and understand the process of closing your account when the loan is fully repaid.

This guide will walk you through the steps involved in closing, deleting, or deactivating your OKash loan account effectively.

Whether you have repaid your loan and no longer require the service or prefer to take a break from using Okash, understanding the account termination process is crucial.

Before embarking on the loan closure process, it’s essential to grasp the underlying principles and considerations involved.

Reasons for Closing a Loan Account

There are various reasons why an individual might consider closing their OKash loan account. These reasons may include;

Full Repayment: Once the loan is fully repaid, there’s no further need to maintain an active loan account.

Consolidating Debts: Combining multiple loans into a single one with better terms may necessitate closing existing accounts.

Reducing Financial Footprint: Minimizing the number of active financial accounts can simplify personal finance management.

Personal Preferences: An individual may choose to close their OKash account due to personal preferences or changes in financial circumstances.

Impact of Loan Closure on Creditworthiness

Closing a loan account in good standing, with a history of timely repayments, have a very good positively impact your creditworthiness.

However, it’s important to note that closing an account too early or having a limited credit history can also affect your credit score.

Requirements for Closing, Deleting, or Deactivating Your Okash Account

Before embarking on the account termination process, ensure you have fulfilled the following prerequisites:

- Before closing or deactivating your account, it is essential to ensure you have cleared all outstanding loan balances. Failure to do so may result in legal repercussions and affect your creditworthiness.

- To initiate the account termination process, you must have a registered Okash account and possess valid access credentials, including your registered phone number and password or PIN.

- A stable internet connection is necessary for accessing the Okash mobile app or website, which are the primary channels for managing your account.

Methods for Closing, Deleting, or Deactivating Your Okash Account

Okash offers two primary methods for closing, deleting, or deactivating your account, these include; through the mobile app or by contacting customer support.

Closing Your Okash Account Through the Mobile App

- Begin by launching the Okash mobile app on your smartphone. Ensure you have an active internet connection. Once the app is open, log in to your account using your registered phone number and password or PIN.

- Once successfully logged in, locate and navigate to the “Account” section within the Okash mobile app. This section typically houses your account information and settings.

- Within the “Account” section, identify and select the “Close Account” option. This option will initiate the account closure process.

- A confirmation prompt will appear, asking you to verify your decision to close your Okash account. Carefully review the prompt and ensure you are ready to proceed with the closure.

- To confirm your identity and prevent unauthorized account closure, you will be prompted to enter your Okash PIN or password. Enter the correct credentials to proceed.

Your Okash Account Will Be Closed Permanently: Upon successful verification, your Okash account will be permanently closed. You will receive a confirmation message notifying you of the account closure.

How to close Okash account by contactingOkash Customer Support

Alternatively, you can close, delete, or deactivate your Okash account by contacting Okash customer support. This method is particularly useful if you encounter any difficulties with the mobile app method.

- Depending on your preference, either open the Okash mobile app or access the Okash website using a web browser. Ensure you have a stable internet connection.

- Navigate to the “Customer Support” or “Contact Us” section within the Okash mobile app or website. This section provides contact information and support options.

- Okash offers various communication channels for customer support, including phone, email, or live chat. Select the method that best suits your needs and preferences.

- Once connected with a customer support representative, clearly express your intention to close, delete, or deactivate your Okash account. They will guide you through the process.

- To verify your account ownership and initiate the closure process, you will be asked to provide your Okash account details, such as your registered phone number, email address, or any other relevant information.

- Upon successful verification of your account ownership, the customer support representative will proceed with closing, deleting, or deactivating your Okash account. They may provide further instructions or confirmation details.

In addition to closing your Okash account permanently, you may consider alternative options that provide more flexibility:

Deactivating Your Okash Account Temporarily

If you wish to take a break from using your Okash account but may need it again in the future, consider deactivating it temporarily. This option allows you to retain your account information and easily reactivate it when needed.

Step 1: Access Your Okash Account Through the Mobile App or Website

Log in to your Okash account using the mobile app or website, ensuring a stable internet connection.

Step 2: Navigate to the “Settings” or “Account Management” Section

Locate and access the “Settings” or “Account Management” section within the Okash app or website. This section typically houses account preferences and management options.

Step 3: Locate the “Deactivate Account” or “Pause Account” Option

Within the “Settings” or “Account Management” section, identify and select the “Deactivate Account” or “Pause Account” option. This option will initiate the temporary account deactivation process.

Step 4: Confirm Your Decision to Temporarily Deactivate Your Account

A confirmation prompt will appear, asking you to verify your decision to temporarily deactivate your Okash account. Carefully review the prompt and ensure you are ready to proceed.

Step 5: Enter Your Okash PIN or Password for Verification

To confirm your identity and prevent unauthorized account deactivation, you will be prompted to enter your Okash PIN or password. Enter the correct credentials to proceed.

Step 6: Your Okash Account Will Be Temporarily Deactivated

Upon successful verification, your Okash account will be temporarily deactivated. You will receive a confirmation message notifying you of the temporary deactivation. To reactivate your account at any time, simply log in using your registered phone number and password or PIN.

How to repay Your Outstanding Loan Balance

If you have an outstanding loan balance on your Okash account but wish to close it later, consider repaying the balance in full. Once the balance is cleared, you can proceed with closing or deactivating your account.

Step 1: Log In to Your Okash Account and Check Your Outstanding Loan Balance

Access your Okash account through the mobile app or website and navigate to the “Loans” or “Account Summary” section to view your outstanding loan balance.

Step 2: Utilize the Available Repayment Methods

Okash offers various repayment methods for settling your loan balance. Select the most convenient method for you, such as bank transfer, mobile money, or debit card payment.

Step 3: Make the Full Payment to Clear Your Outstanding Balance

Initiate the repayment process and make the full payment to clear your outstanding loan balance. Ensure the payment is processed successfully.

Step 4: Once the Payment Is Processed, You Can Consider Closing or Deactivating Your Account

Upon confirmation of the full payment, you can proceed with closing or deactivating your Okash account as described in the previous methods.

Conclusion

Closing, deleting, or deactivating your Okash account is a straightforward process that can be completed using the mobile app or by contacting customer support.

Remember to settle all outstanding loan balances before initiating account closure. Consider temporary deactivation if you may need the account again in the future. For further assistance or account management inquiries, refer to the Okash website or customer support channels.

FAQS

How do I cancel my Okash loan?

You can cancel your Okash loan within 24 hours of disbursement by repaying the principal amount of the loan within 24 hours of disbursement or Contact Okash customer service at or +234 817 904 9044 to inform them of your cancellation request.

Please note that you will not be able to cancel your loan after 24 hours of disbursement.

If you fail to repay the principal amount within 24 hours, you will be charged interest and late fees.

What happens when you don’t pay Okash?

Okash charges late fees for any payments made after the due date. The late fee is 2% of the outstanding balance per day.

In fact, you will continue to accrue interest on your loan until it is fully repaid.

Is OPay the owner of OKash?

No, OPay is not the owner of OKash. OKash was originally founded by OPay, but in December 2018, Opera acquired OKash from OPay for $9.5 million. As a result, OKash is now a subsidiary of Opera, and OPay is no longer affiliated with the company.