Opening a bank account and managing your finances has never been easier, thanks to the digital age. However, despite this glaring convenience, the process at times be discouraging because of the complexity, leaving you frustrated.

Beyond the inconvenience, research shows that poor financial management can lead to missed opportunities. To avoid that, I am here to guide you on how to open a Kuda Bank account and teach you the fast way of making payments with the Kuda Bank app.

Let’s move on.

Why Choose Kuda Bank for Your Banking Needs?

There are so many reasons you should consider Kuda bank for your banking needs, they include;

- Zero Fees: Kuda Bank prides itself on being a fee-free banking platform. No maintenance charges, card fees, or transaction fees eat into your hard-earned money.

- High Interest Savings: With Kuda Bank, you can earn interest on your savings. This feature makes it an attractive option for those looking to grow their money over time.

- Easy Account Opening: Opening a Kuda Bank account is a breeze, thanks to the intuitive mobile app. You can get started in a matter of minutes, without the need for lengthy paperwork.

Steps on How to Open a Kuda Bank Account

Opening a Kuda Bank account is a straightforward process that can be completed using the Kuda Bank app. Here’s how to do it:

Step 1: Download the Kuda Bank App

Start by downloading the Kuda Bank app from the App Store or Google Play Store. This app is available for both iOS and Android devices.

Step 2: Sign Up

After installing the app, open it and click on the “Sign Up” button. You’ll need to provide your phone number and create a secure password. An OTP (One-Time Password) will be sent to your phone for verification.

Step 3: Personal Information

Once verified, you’ll be prompted to enter your personal information, including your full name, date of birth, and address.

Step 4: BVN and KYC Verification

To comply with regulatory requirements, you’ll need to enter your Bank Verification Number (BVN) and complete the Know Your Customer (KYC) process. This typically involves uploading a photo of a government-issued ID, a selfie, and other relevant documents.

Step 5: Fund Your Account

Once your identity is verified, you can fund your Kuda Bank account. The app provides various options for adding funds, such as through a bank transfer or card payment.

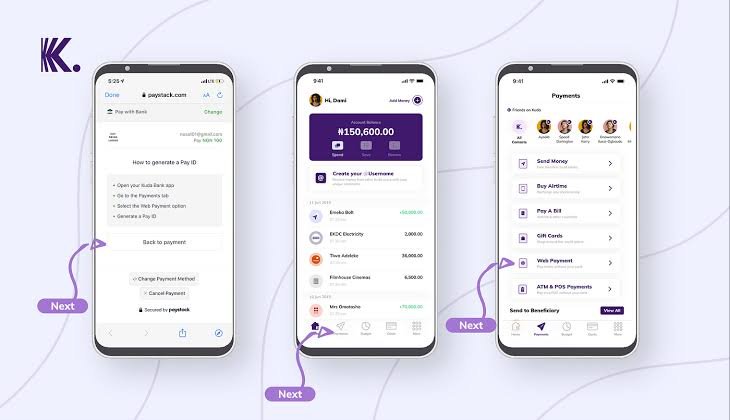

How do make Payments with the Kuda Bank App

The Kuda Bank app not only allows you to manage your account but also make you to make payments with ease. It doesn’t care if you need to send money to a friend, pay bills, or make online purchases, the app has you covered.

Step 1: Access Your Account

Open the Kuda Bank app and log in to your account using your secure password or biometric authentication.

Step 2: Navigate to the Payment Section

Within the app, locate the “Payments” or “Send Money” section. This is where you’ll initiate various types of transactions.

Step 3: Select the Payment Type

Choose the type of payment you want to make. This could include sending money to another Kuda Bank user, making a bank transfer, or paying a bill.

Step 4: Enter Payment Details

Provide the necessary payment details. If you’re sending money to another Kuda Bank user, you might need their phone number or email linked to their Kuda Bank account. For other transactions, you’ll need the recipient’s bank details.

Step 5: Confirm and Authenticate

Review the payment details to ensure accuracy. Depending on the transaction, you might need to enter your password, provide biometric authentication, or input an OTP for security.

Once the payment is confirmed, you’ll receive a notification indicating the successful transaction. The recipient will also be notified of the incoming funds.

How to make payments with Kuda Bank

Kuda Bank makes it easy to make payments to friends, family, businesses, andloved ones. To do that, follow this steps;

- Send money to another Kuda user: To send money to another Kuda user, open the Kuda Bank mobile app and tap on the “Pay” tab. Enter the recipient’s Kuda username and the amount you want to send. Tap on the “Send” button to complete the transaction.

- Send money to a bank account: To send money to a bank account, open the Kuda Bank mobile app and tap on the “Pay” tab. Select the “Bank Transfer” option and enter the recipient’s bank account details. Tap on the “Send” button to complete the transaction.

- Pay bills: To pay bills with Kuda Bank, open the Kuda Bank mobile app and tap on the “Pay Bills” tab. Select the biller you want to pay and enter the bill amount. Tap on the “Pay” button to complete the transaction.

- Buy airtime and data: To buy airtime and data with Kuda Bank, open the Kuda Bank mobile app and tap on the “Buy Airtime & Data” tab. Select the network you want to buy airtime or data for and enter the amount you want to buy. Tap on the “Buy” button to complete the transaction.

Conclusion

Thanks for reading to this end. I am sure you have learnt the best and simple way on how to make payments in your Kuda bank account, how to open an account and make other necessary transactions. Make sure you share with your love ones.

FAQS

Can I use Kuda to receive money?

Yes, you can use Kuda to receive money from other Nigerian banks.

Can Kuda bank be used for online payment?

Yes, Kuda bank can be used for online payment. You can use your Kuda account to make payments on websites and apps that accept payments through Paystack.

How long does Kuda verification take?

The verification process usually takes 24-72 hours. However, it may take longer if your ID document is damaged or if there are other issues with your application.

Can I use Kuda without BVN?

Yes, you can open a Kuda account without a BVN. However, there are some limitations to what you can do with your account without a BVN which one is that you can only send and receive nothing less than 200,000 daily.