Are you looking forward to obtaining a loan online? Do you want hassle-free loan? Look no further.

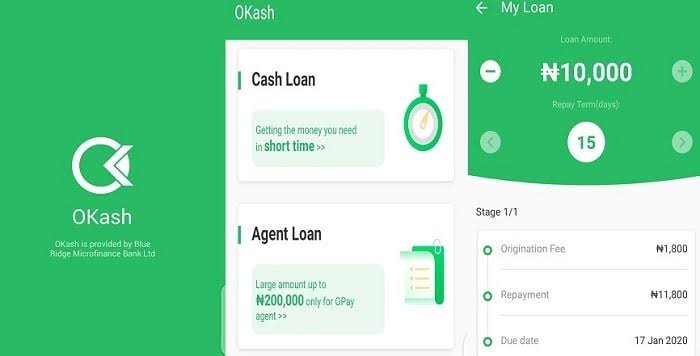

Okash is a mobile lending app that provides short-term loans to individuals in Nigeria. The app is available for download on both Android and iOS devices.

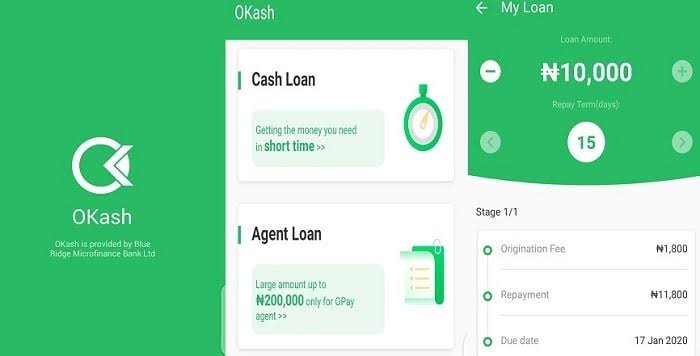

Okash loans are typically for small amounts of money, up to NGN50,000. The interest rates on Okash loans are relatively high, but the application process is quick and easy.

Who is eligible for an Okash loan?

To be eligible for an Okash loan, you must meet the following criteria:

- Be a Nigerian citizen

- Be at least 18 years old

- Have a valid ID card

- Have a bank account

- Have a regular source of income

How does Okash work?

The first step in obtaining an Okash loan is to download the Opay app, which serves as the gateway to various financial services, including Okash loans. You can find the Opay app on both the Google Play Store for Android devices and the App Store for iOS devices. Simply search for “Opay” in the respective app store, and install the app on your smartphone.

Step 2: Create and Verifying Your Account

Once you’ve downloaded the Opay app, it’s time to create your account. Launch the app and follow the registration process, providing the necessary information such as your phone number and email address. After completing the initial registration, you’ll be prompted to verify your identity. This is a crucial step in ensuring the security of your transactions and data.

Step 3: Selecting the “Okash” Loan Option

With your Opay account created and verified, navigate through the app to find the “Okash” loan option. This is where you’ll start the process of applying for your loan. The app’s user-friendly interface makes it easy to locate and select the loan section.

Step 4: Providing Your Personal Information

To proceed with your loan application, you’ll need to provide some personal details. Okash requires information such as your full name, residential address, phone number, ID card number, and bank account number. It’s essential to ensure that the information you provide is accurate and up-to-date to avoid any delays in the application process.

Step 5: Submitting Your Loan Application

Once you’ve entered your personal information, review it to make sure everything is accurate. After confirming the accuracy of your details, you can submit your loan application through the app. The information you’ve provided will be used by Okash to assess your eligibility for the loan.

After submitting your application, Okash will review your information and assess your eligibility for the loan. The approval process typically takes just a few minutes. This quick turnaround time is one of the key benefits of using Okash for urgent financial needs.

Factors Considered for Loan Approval

Okash considers several factors when reviewing loan applications. These factors include your credit score, income, employment history, debt-to-income ratio, and repayment history. This holistic approach helps Okash make informed decisions and ensures that borrowers are provided with loans that they can comfortably repay.

Congratulations! If your loan application is approved, you’ll receive a notification through the Opay app. The approved loan amount will be deposited directly into the bank account you provided during the application process. This usually happens within 24 hours of approval.

How to Repay Your Okash Loan

Repaying your Okash loan is a straightforward process designed for your convenience. You can make repayments directly through the Opay app. It’s important to adhere to the repayment schedule to avoid any late fees or potential legal actions.

Conclusion

Getting loan from Okash simple and straightforward. Do make sure you meet all their needs and get your loan approved. Congratulations for the financial freedom

FAQ

How can I borrow loan from my Opay app?

There are two ways to go about it. One, follow the step I mentioned above. On the other hand, you can apply through USSD code.

- Dial *955# on your phone.

- Select the “loans” option.

- Follow the instructions to apply for a loan.

Is Opay connected to OKash?

Opay and OKash were once connected. OKash was a loan service offered by Opay. However, in January 2020, Opay removed the OKash loan feature from its app due to heavy backlash on its lending policy.

Is OKash loan app still working?

No, the OKash loan app is no longer working. It was shut down by the Nigerian government in January 2020 due to its high interest rates and aggressive lending practices.

The OKash loan app was criticized for charging borrowers up to 24% interest per month. This is much higher than the average interest rate for loans in Nigeria, which is around 10% per year.