Flypay is an online lending platform that provides shortterm personal loans to individuals in Nigeria. In this comprehensive guide, we will take an indepth look at Flypay Pro Loan App, its services, features, legitimacy, customer care support and more.

Flypay is a digital lending platform that allows Nigerians to apply for and receive cash advances or personal loans completely online.

Is Flypay Legitimate and Regulated?

As an online lending company operating in Nigeria, Flypay is regulated and registered under the appropriate financial authorities:

- Licensed and regulated by the Central Bank of Nigeria (CBN).

- Registered with the Corporate Affairs Commission (CAC) as a private limited liability company.

So in terms of legitimacy and regulations, Flypay checks all the right boxes to be considered a licensed and legal online lending platform in Nigeria.

Flypay Loan Application Process

Here are the simple steps to apply for a loan on Flypay:

1. Download the Flypay loan app from the Google Play Store or Apple App Store.

2. Sign up by entering your basic personal details like name, phone number, email and date of birth.

3. Verify your identity by uploading clear photos of your valid ID card and selfie.

4. Select the required loan amount between ₦5,000 to ₦500,000.

5. Review and agree to the loan terms and conditions.

6. Your loan application will be processed instantly and you will be notified of approval or decline via email or SMS.

7. Once approved, the funds will be disbursed directly to your linked bank account within minutes.

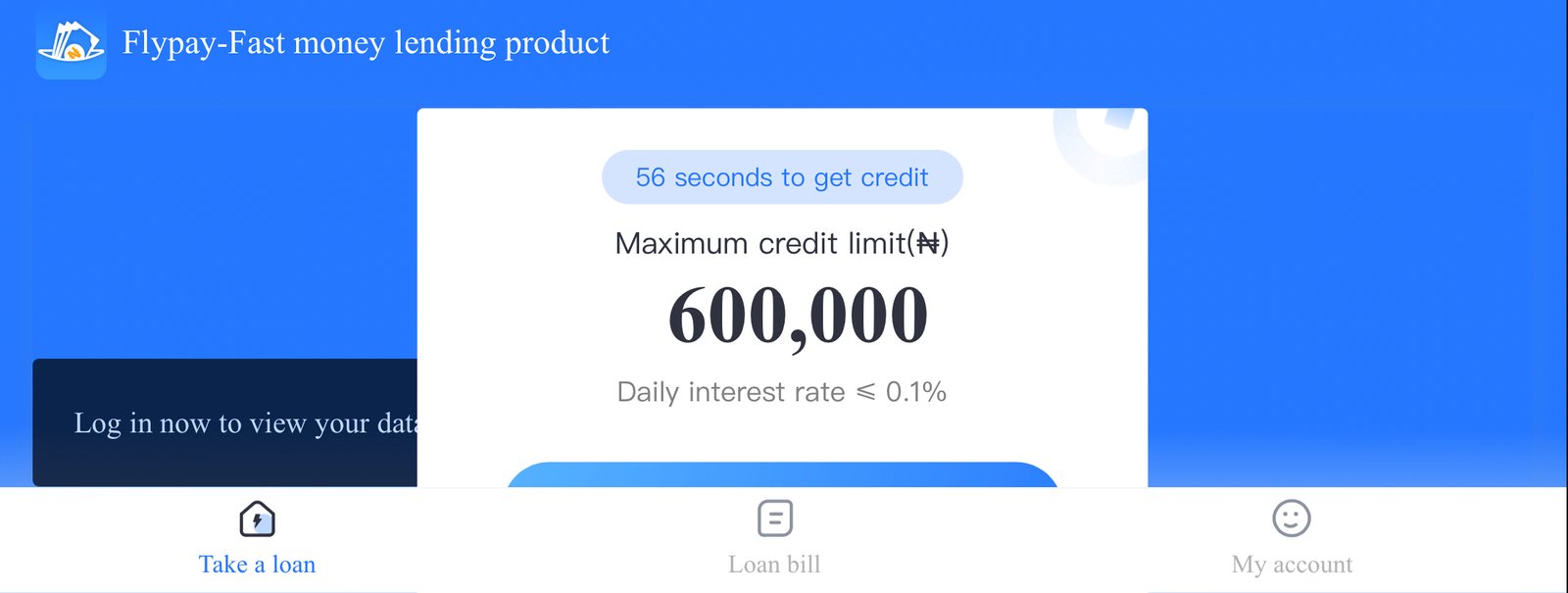

Features of Flypay Loan App

- Instant online loan applications from the convenience of your phone.

- Funds disbursed directly to linked bank account within 5-10 minutes of approval.

- Competitive interest rates starting from 5% monthly depending on loan amount.

- Flexible repayment period between 36 months.

- 24/7 customer support via phone call, email, live chat or social media.

- Free to download app available on both Android and iOS platforms.

- App sends notifications for repayment reminders to avoid penalties.

- Quick and seamless digital account management via the app.

How to Repay Your Flypay Loan

Repaying your Flypay loan on time is important to maintain a good credit rating. Here’s how repayments work

- You will be required to pay back your loan amount plus interest charges in monthly installments.

- Your repayment schedule breakdown will be clearly shown in the app and loan agreement.

- You can make repayments from any bank using Flypay repayment code sent via SMS.

- Alternatively, set up a standing order where repayments are autodebited from your linked account.

- Make sure each installment is paid before the due date to avoid penalties.

- Late or missed repayments will reflect poorly on your credit score for future loans.

Read also: Flypay-Naira Cash Loan Login With Phone Number, Email, Online Portal, Website

Flypay Fees and Interest Rates

Interest rates range from 5-10% flat monthly depending on loan amount.

No hidden charges or penalties for early repayment.

2% processing fee gets deducted from loan disbursement amount.

₦100 is charged if repayment isn’t made on agreed date. Extra ₦50 is charged daily for delays.

Default on any installment may lead to blacklisting and legal actions.

Customer Support and Complaint Resolution

For any issue relating to Flypay loans, you can reach out to their customer care team through the following channels:

- Call their tollfree number: 08001003035

- Send a message via the inapp live chat

- Email: support@flypay.co

- Twitter: @flypayng

- Facebook: @flypayng

If you have a genuine complaint about Flypay that wasn’t adequately addressed, you can also escalate it to regulatory authorities like CAC and CBN for investigation and resolution.

Common FAQs about Flypay and Easy Loan Repayment

Is FlyPay on iPhone?

Yes, FlyPay is available on iPhone as a finance app for users in Nigeria, offering loans ranging from ₦10,000 to ₦300,000 with a user-friendly interface and flexible repayment options.

Which loan app does not request for BVN?

The loan app that does not request for BVN (Bank Verification Number) is Flypay-Naira Cash Loan.

The search results indicate that Flypay-Naira Cash Loan is a free finance app for iPhone, offering loans ranging from ₦10,000 to ₦300,000 with a user-friendly interface and flexible repayment options, without requiring the user’s BVN.

Conclusion

In summary, Flypay provides a fast and convenient way for Nigerians to access instant online loans digitally. However, it is important borrow responsibly by carefully considering your repayment capacity and not taking on more debt than you can handle. Always read all terms and conditions carefully before signing up. If used judiciously, Flypay loan app can be a reliable financing option for shortterm financial needs.

Do you have any other questions about Flypay loan app that weren’t covered in this article? Feel free to leave a comment below and I’ll get back to you. You can also check out alternative personal loan apps in Nigeria.