Are you looking for the best way to obtain loan from Crefitwise? If so this post is for you.

Creditwise Loan Nigeria is one of the leading online loan companies in Nigeria that provides instant cash loans and financing solutions. Founded in 2019, the company aims to offer easy and flexible loan products to help Nigerians meet their urgent financial needs.

Key Features of Creditwise Loan Nigeria

Some of the key features that make Creditwise Loan Nigeria a popular choice for instant personal loans include:

Speedy Loan Application and Approval Process

Applying for a loan from Creditwise Loan Nigeria is straightforward and hassle-free. Loan seekers can apply online via the company’s website or mobile app. The online application process takes less than 5 minutes to complete. Loan decisions are also quick, with many applicants receiving their loan funds within 24 hours of approval.

Flexible Loan Amounts

Creditwise Loan Nigeria offers flexible loan amounts ranging from ₦50,000 to ₦500,000, allowing borrowers to borrow exactly what they need. The loan repayment period ranges from 3 to 12 months.

No Collateral Required

Unlike traditional bank loans, Creditwise Loan Nigeria does not require collateral or guarantors. Borrowers can access financing based on their credit history and ability to repay.

Competitive Interest Rates

The interest rates charged on Creditwise Loan Nigeria loans are competitive compared to rates offered by other instant loan companies in Nigeria. Rates start from 2% per month for 3-month repayment tenures.

Round-the-Clock Customer Support

Loan applicants and existing customers can access Creditwise Loan Nigeria’s customer support team via phone, email, live chat or social media at any time. The company prides itself in offering excellent pre-and post-loan customer service.

How to Apply for a Creditwise Loan Nigeria

Here are the simple steps to apply for an instant personal loan from Creditwise Loan Nigeria:

- Go to www.creditwiseloannigeria.com either on your computer or mobile device. You will find all the loan products and application details on the homepage.

- Fill out the online application form by providing your name, contact details, ID number, proof of residence, employment details and monthly income.

- Choose the exact loan amount you need within the eligible range and select your preferred repayment period of 3 to 12 months.

- Attach clear copies or photos of your valid ID, recent utility bill and bank statement as proof of identity and residence.

- Allow Creditwise Loan Nigeria to view your credit history for a quick check. This is done electronically without any hard credit inquiries.

- Most applicants receive a loan decision immediately. If approved, you will be notified about next steps to access your funds.

Interest Rates and Other Loan Terms

Here are the current interest rates and other key terms for Creditwise Loan Nigeria loans:

- Monthly Interest Rates: 2% – 5% (Rates may vary based on repayment period and credit profile)

- Loan Amounts: ₦50,000 – ₦500,000

- Repayment Periods: 3, 6, 9 or 12 months

- Repayment Method: Equal monthly installments via auto-debit

- Late Payment Fees: 5% of monthly installment amount

- Prepayment Charges: Nil (Borrowers can repay early without penalty)

Customer Care Contact Details

For any loan-related queries, assistance or complaints, borrowers can reach out to Creditwise Loan Nigeria through the following channels:

Call: +234 706 000 0000

WhatsApp: +234 904 000 0000

Email: support@creditwiseloannigeria.com

Website Chat: www.creditwiseloannigeria.com

Facebook: @CreditwiseLoanNG

Twitter: @CreditwiseLoan

Representatives are available via call/chat 7 days a week from 8:00 AM to 8:00 PM. The company aims to respond to online queries within 24 hours.

FAQs about Creditwise Loan Nigeria

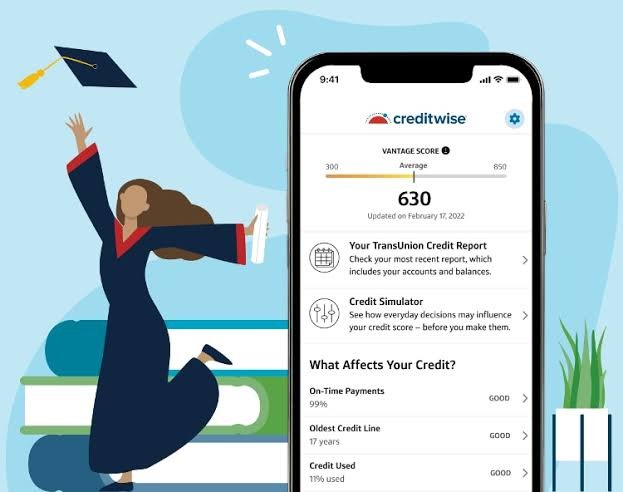

Is CreditWise a legit credit score?

Yes, CreditWise is a legitimate credit monitoring tool that provides free credit scores and reports, alerts for changes, and credit improvement suggestions. It uses the TransUnion VantageScore 3.0 model and offers insights into credit health without impacting credit scores.

How much does CreditWise cost?

CreditWise is a free credit monitoring service that does not charge any fees for its use.

What credit score do I need to borrow money?

To borrow money, the required credit score varies by lender. Generally, for personal loans, a credit score of at least 610 to 640 is needed to qualify, with higher scores leading to more favorable terms like lower interest rates

Conclusion

In conclusion, Creditwise Loan Nigeria has quickly become one of the leading and most trusted sources for instant personal loans in Nigeria.

From a hassle-free application to flexible terms and round-the-clock customer support, it offers a convenient financing solution to tackle unplanned expenses.

With competitive rates, full transparency and growing customer satisfaction ratings, Creditwise Loan Nigeria stands out as a reliable option for those seeking access to quick, easy and affordable online loans in Nigeria.