Whether you’re sending money to loved ones or conducting business transactions, the last thing you want is to see your hard-earned money eroded by hefty transfer fees. We’ve all been there searching for a solution to the problem of exorbitant fees when all you want is a seamless and cost-effective way to move your funds

However, fear not, for there’s a solution that can save you from this mess.

Today, we’re here to share a comprehensive list of banks that have embraced free money transfer without a fee.

What are transfer fees?

Transfer fees are charges that banks levy on customers who transfer money between accounts at different banks. The amount of the transfer fee varies from bank to bank.

Why do banks charge transfer fees?

Banks charge transfer fees for a number of reasons. One reason is to cover the costs of processing the transaction. Another reason is to make money. Banks make a profit from every transaction they process.

What are the different types of transfer fees?

There are two main types of transfer fees namely, interbank transfer fees and intrabank transfer fees.

Interbank transfer fees are charged when you transfer money from an account at one bank to an account at another bank.

Intrabank transfer fees are charged when you transfer money from an account at one bank to another account at the same bank.

Why Zero Transfer Fees Matter

Before diving into the list of banks offering fee-free transfers, let’s take a moment to understand why this matters. Transfer fees might seem insignificant at first glance, but they can accumulate over time, especially if you frequently send money. Imagine sending regular monthly allowances to your loved ones or processing numerous business transactions those fees can quickly eat into your budget. By opting for banks that offer zero transfer fees, you’re effectively ensuring that your money goes where it’s intended, without unnecessary deductions.

List of Banks That Charge Zero Transfer Fees Apart from Opay and VBank

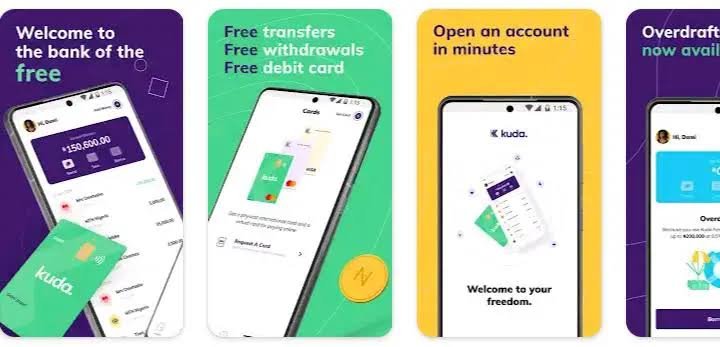

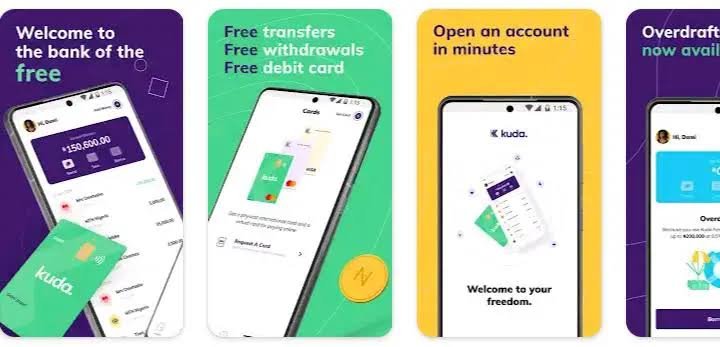

Kuda Bank

Kuda Bank emerges as a standout choice when it comes to fee-free transfers. With a user-centric approach, Kuda Bank provides its customers with a seamless experience for moving money. Opening an account with Kuda Bank is a straightforward process, often requiring just a few minutes and a smartphone. Once you’re set up, you can enjoy the convenience of fee-free transfers with a few taps on your screen.

How To initiate a fee-free transfer with Kuda Bank

- Download the Kuda Bank app: Head to your app store, download the Kuda Bank app, and sign up for an account.

- Link your account: Link your Kuda Bank account to your other accounts, if needed, to facilitate seamless transfers.

- Enter transfer details: Enter the recipient’s information and the amount you wish to transfer.

- Review and confirm: Double-check the details and confirm the transfer

Carbon

The second in my list is Carbon. This is another player in the fee-free transfer game, it offers a user-friendly platform for managing your finances. With its emphasis on a seamless experience, Carbon lets you transfer money without any hassle. The process is designed to be intuitive, making it an excellent choice for those who are new to digital banking.

How to Transfer money through Carbon

- Access your Carbon account: Log in to your Carbon account via the app or website.

- Navigate to the transfer section: Locate the option to transfer money within the app’s interface.

- Enter recipient details: Provide the recipient’s name, account number, and other necessary details.

Flutterwave

When it comes to international money transfers, Flutterwave shines by offering zero-cost remittances. This makes it an appealing option for those who need to send money across borders without worrying about hefty fees.

How To make a fee-free international transfer with Flutterwave

- Sign up for a Flutterwave account: Create an account on the Flutterwave platform.

- Initiate a remittance: Choose the remittance option and enter the recipient’s international account details.

- Confirm the transfer: Review the transfer details and confirm the transaction all without incurring transfer fees.

Eyowo

Eyowo positions itself as a solution for fee-free peer-to-peer transactions. Its user-friendly interface and robust security measures make it a popular choice among users who want to send and receive money without fees.

How to Send money using Eyowo

- Log in to your Eyowo account: Access your Eyowo account through the app or website.

- Initiate a transfer: Select the option to send money and provide the recipient’s details.

- Confirm the transfer: Review the transfer information, ensure accuracy, and confirm the transfer all with the assurance that no fees will be deducted from your transaction.

Alat by Wema

Alat, a digital banking platform, distinguishes itself by offering zero charges for transfers. In addition to fee-free transfers, Alat provides a range of other banking features, making it a comprehensive financial management platform.

what other banks charge N10 as transfer fees like Kuda and PalmPay?

Kuda Bank is a digital bank that offers a variety of banking services, including savings accounts, current accounts, and debit cards. Kuda Bank charges N10 for interbank transfers made through its mobile app.

PalmPay is also a mobile wallet that allows users to make payments, send money, and buy airtime and data. PalmPay like Kuda charges N10 for interbank transfers made through its mobile app.

Other banks that do charges N10 per transaction include;

1 Rubies

Rubies Digital Bank is a digital bank that offers a variety of banking services, including savings accounts, current accounts, and debit cards. Rubies Digital Bank charges N10 for interbank transfers made through its mobile app.

2 OPay

is a mobile payments app that allows users to make payments, send money, and buy airtime and data. OPay charges N10 for interbank transfers made through its mobile app.

3 Chipper Cash

Chipper cash is a mobile payments app that allows users to send money to other Chipper Cash users in Nigeria and Ghana. Chipper Cash charges N10 for interbank transfers made through its mobile app.

These apps all charge N10 for interbank transfers, regardless of the amount of money being transferred. This is a relatively low fee, and it is comparable to the fees charged by other banks and mobile payment apps in Nigeria.

Conclusion

Thank you for reading to this end. That’s all about the list of Banks That Charge Zero Transfer Fees Apart from Opay and VBank.

FAQs (Frequently Asked Questions)

What is the alternative to Kuda bank?

- VBank

- Palmpay

- OPAY

- Rubies

- Sparkle

- Mintyn Digital Bank

- Eyowo

- Fundall

- goMoney

Do all banks have transfer fees?

No, not all banks have transfer fees. Some banks offer free transfers for certain types of transfers, such as domestic transfers or transfers between accounts at the same bank.

Can Kuda Bank receive dollars?

No, Kuda Bank cannot receive dollars directly. Kuda Bank is a digital bank that operates in Nigeria and only offers accounts in Nigerian naira (NGN). If you need to receive dollars in Nigeria, you will need to open a domiciliary account with a traditional bank.