Are you in need of urgent loan? Do you need up to 10, or 30 thousand Naira now? If yes, this article is for you.

In this blog post, I will provide you with the ultimate guide on how to borrow up to 30,000 naira and also reveal the top apps that you can borrow money from in Nigeria.

Let get started.

Borrowing money comes with a lot of paper work. I have a good news for you. The rise of fintech has brought about a revolution in the Nigerian financial sector, with loan apps emerging as a popular and convenient solution for accessing short-term loans.

In Nigeria, there are a variety of loan apps that offer loans ranging from N10,000 to N100,000. These apps typically have a quick and easy application process, and you can often get approved for a loan in just a few hours.

Benefits of Using Loan Apps

Loan apps offer several advantages over traditional lending institutions, making them an attractive option for many Nigerians. These benefits include:

- Convenience: Loan apps can be accessed from anywhere, anytime, using a smartphone.

- Speed: The application and approval process for loans is typically fast and efficient.

- Flexibility: Loan amounts and repayment terms can be tailored to individual needs.

- No paperwork: Loan apps typically require minimal documentation, making the process hassle-free.

Factors to Consider When Choosing a Loan App

Interest Rates

Interest rates play a significant role in determining the overall cost of your loan. Compare interest rates offered by different loan apps to find the most affordable option.

Loan Amounts

Ensure the loan app provides the loan amount that aligns with your specific financial requirements.

Repayment Terms

Carefully review the repayment terms, including the repayment period and frequency, to ensure they fit within your budget and financial capabilities.

Eligibility Requirements

Meet the eligibility criteria set by the loan app to enhance your chances of loan approval. These requirements may include age, residency status, income level, and credit history.

Customer Reviews

Read customer reviews and testimonials to gain insights into the user experience, customer service, and overall reliability of the loan app.

Best Loan Apps for N10,000 Loans

If you’re looking for a loan of N10,000 or less, there are a few great options available.

Branch

Branch offers flexible loan amounts ranging from N1,000 to N50,000, with N10,000 loans being the most popular choice. Repayment terms vary from 3 to 30 days, and interest rates are among the lowest in the industry. Branch is known for its user-friendly interface and excellent customer service.

Kuda Bank

Kuda Bank is a digital bank that also offers mobile loans. N10,000 loans are readily available, with repayment terms ranging from 7 to 30 days. Interest rates are competitive, and Kuda Bank is known for its transparent pricing and quick approval process.

BetaLoans

BetaLoans provides short-term loans of up to N10,000 with repayment terms of 7 to 14 days. Interest rates are relatively high, but BetaLoans is known for its fast approval process and convenient loan disbursement.

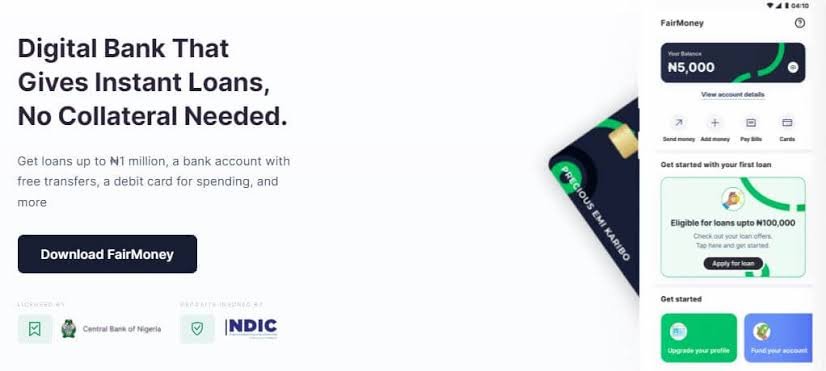

FairMoney

FairMoney offers flexible loan amounts ranging from N500 to N100,000, with N10,000 loans being a popular option. Repayment terms vary from 7 to 30 days, and interest rates are competitive. FairMoney is known for its transparent pricing and focus on financial inclusion.

Alat by Wema

Alat by Wema is a digital banking platform that offers mobile loans of up to N50,000, with N10,000 loans being the most common. Repayment terms range from 7 to 21 days, and interest rates are competitive. Alat by Wema is known for its easy-to-use interface and reliable customer service.

Top 5 Loan Apps for N20,000 Loans

Paylater

Paylater offers flexible loan amounts ranging from N500 to N250,000, with N20,000 loans being a popular option. Repayment terms vary from 7 to 30 days, and interest rates are competitive. Paylater is known for its wide acceptance among merchants and its focus on instant loan disbursement.

QuickBucks

QuickBucks provides short-term loans of up to N20,000 with repayment terms of 2 to 14 days. Interest rates are relatively high, but QuickBucks is known for its fast approval process and convenient loan disbursement.

DigitalSamosa

DigitalSamosa offers flexible loan amounts ranging from N500 to N20,000, with N20,000 loans being a popular option. Repayment terms vary from 7 to 30 days, and interest rates are competitive. DigitalSamosa is known for its transparent pricing and focus on financial inclusion.

OPay

OPay is a mobile payment platform that also offers mobile loans. N20,000 loans are available, with repayment terms ranging from 7 to 21 days. Interest rates are competitive, and OPay is known for its wide acceptance among merchants.

Migo

Migo provides flexible loan amounts ranging from N2,000 to N50,000, with N20,000 loans being a popular option. Repayment terms vary from 7 to 21 days, and interest rates are competitive. Migo is known for its focus on underserved markets and its commitment to providing affordable loans.

Top 5 Loan Apps for N30,000 Loans

Palmcredit

Palmcredit offers flexible loan amounts ranging from N1,000 to N150,000, with N30,000 loans being a popular choice. Repayment terms vary from 7 to 30 days, and interest rates are competitive. Palmcredit is known for its user-friendly interface and excellent customer service.

LoanMe

LoanMe provides flexible loan amounts ranging from N5,000 to N50,000, with N30,000 loans being a popular option. Repayment terms vary from 7 to 30 days, and interest rates are competitive. LoanMe is known for its transparent pricing and focus on financial inclusion.

Aella Credit

Aella Credit offers flexible loan amounts ranging from N500 to N50,000, with N30,000 loans being a popular option. Repayment terms vary from 7 to 30 days, and interest rates are competitive.

How to Apply for a Loan on a Loan App

The application process for loan apps is generally straightforward and can be completed in a matter of minutes.

- Download the app from the Google Play Store or Apple App Store.

- Create an account by providing your personal information, such as your name, email address, phone number, and date of birth.

- Link your bank account to the app.

- Select the loan amount and repayment terms.

- Submit your application.

Once you submit your application, the loan app will review your information and make a decision within a few minutes. If your application is approved, the loan will be deposited into your bank account within 24 hours.

Conclusion

Thanks for reading to this end. Now, I am sure you know the app that suit your need in borrowing the required amount of money.